indiana excise tax alcohol

Monthly Excise Tax Return for Out-of-state Direct Wine Sellers. Type II Gaming Tax.

Indiana Alcohol Taxes Liquor Wine And Beer Taxes For 2022

Other items including gasoline alcohol and cigarettes are subject to various Indiana excise taxes in addition to the sales tax.

. About the Indiana Sales Tax. 10 of total sales. For taxable years beginning before January 1 2021 the tax is imposed at a rate of 14 on gross receipts from all utility services consumed within Indiana.

For taxable years beginning after December 31 2021 and before January 1 2023 the utility receipts tax rate will be 146. Line 8 Enter the number of Indiana tax-paid gallons exported from Indiana to another state. This comes in addition to the local option tax of up to 3 and the states 625 sales tax according to MassLive.

The reason could have something to do with the fact that the tax rate on marijuana is much higher than that of alcohol in such states. The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME which currently offers the ability to manage most tax accounts in one convenient location at intimedoringov. Line 7 Enter the number of Indiana tax-paid gallons used to denature alcohol Gasoline Only.

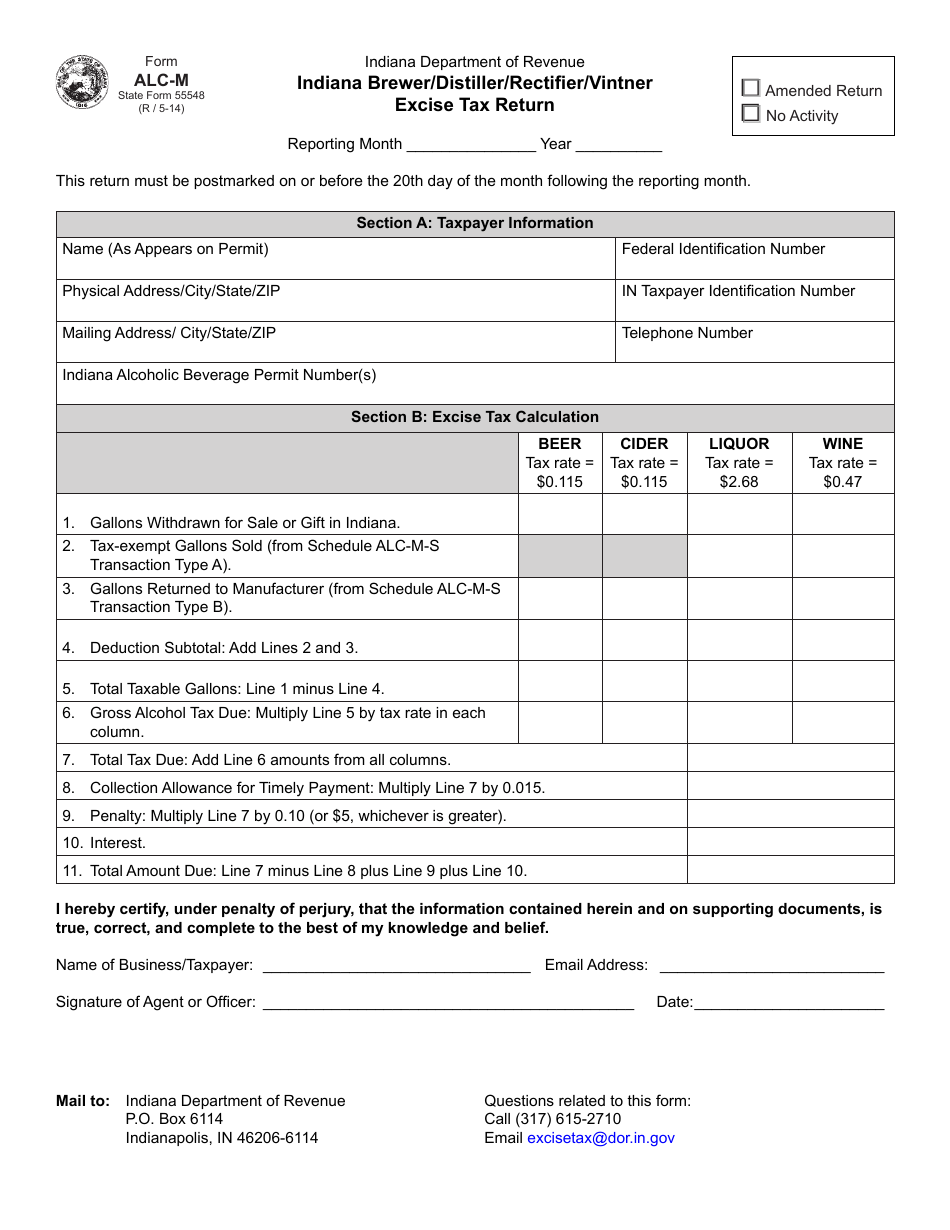

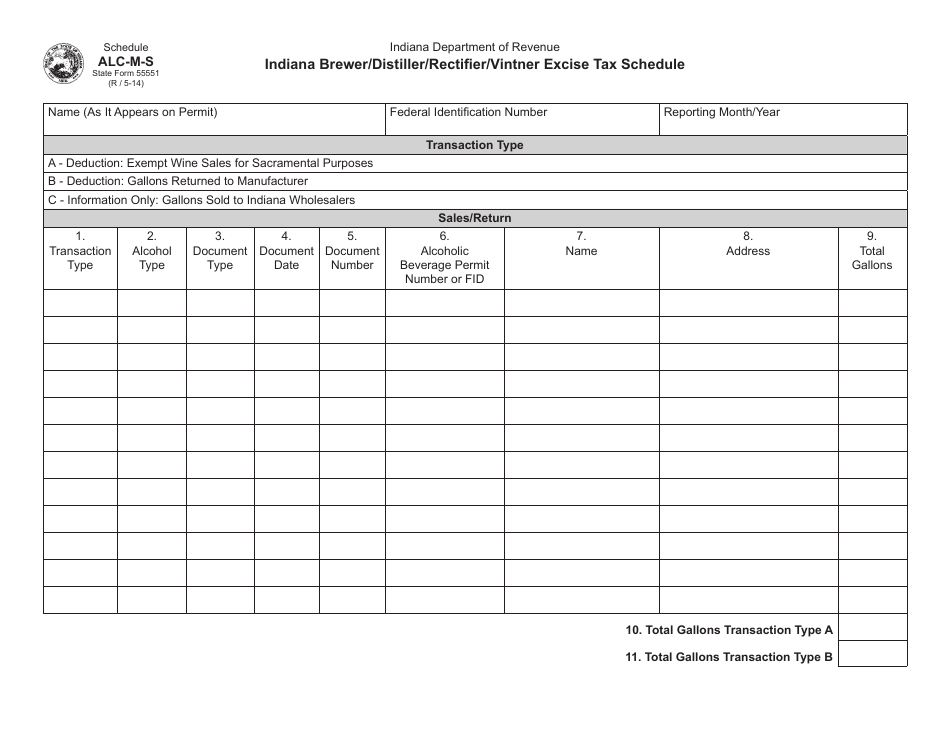

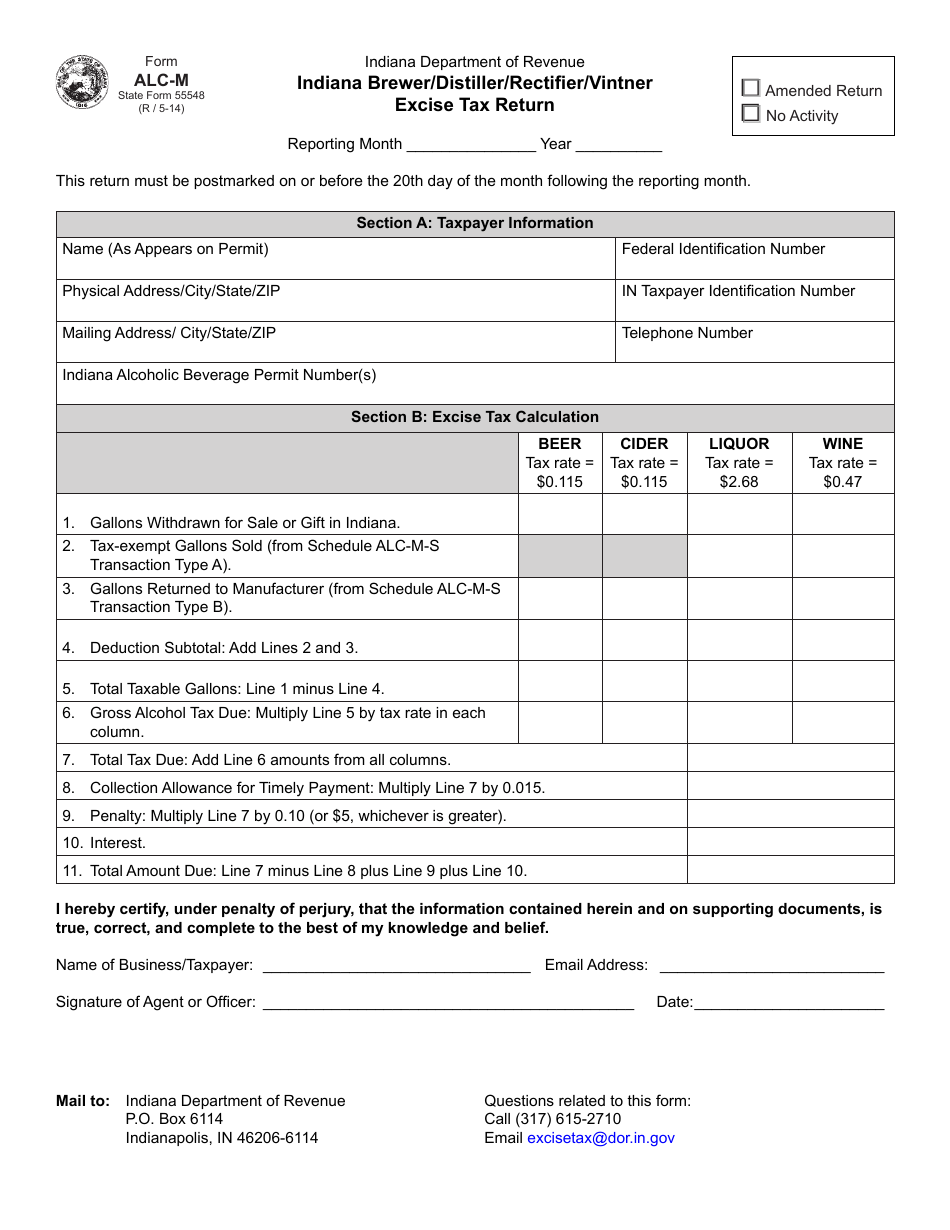

Monthly Excise Tax Return for Indiana-based Breweries Distill-ers Rectifiers and vintners. INtax only remains available to file and pay the following tax obligations until July 8 2022. The state of Indiana has a relatively simple sales tax system consisting of a flat state tax rate in addition to county and local city taxes which will vary significantly depending on which jurisdiction you are inMany localities also have local taxes on restaurant food and beverages.

The Indiana sales tax rate is 7 as of 2022 and no local sales tax is collected in addition to the IN state tax. Monthly Excise Tax Return for Indiana-based Farm Wineries. Gasoline Only Line 10 Enter the.

Line 9 Enter the number of Indiana tax-paid gallons used in a motorboat on Lake Michigan or the Ohio River. For example in Massachusetts the state levies a 1025 excise tax on marijuana products. In some states items like alcohol and prepared food including restaurant meals and some premade.

Monthly Excise Tax Return for Wholesalers.

State Cigarette Excise Tax Rates United States April 2015 Download Scientific Diagram

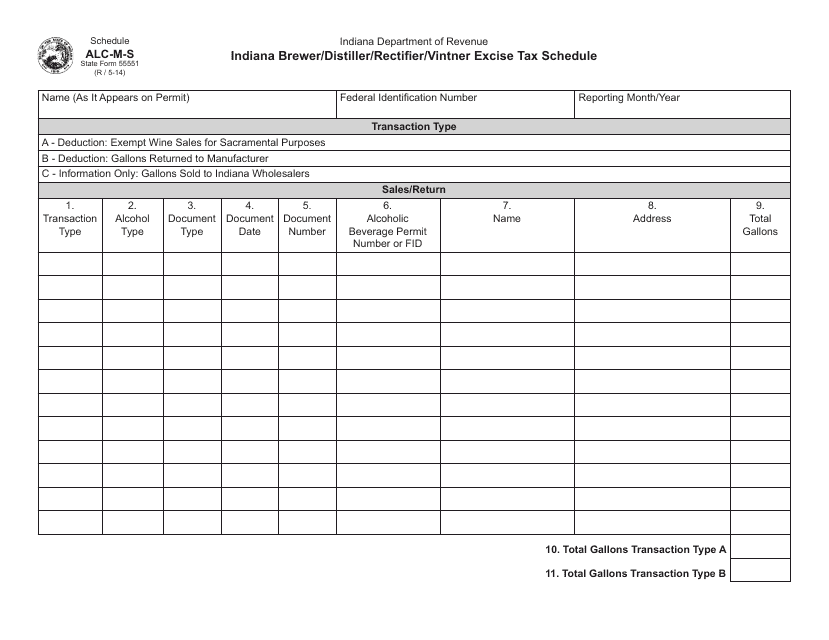

Form Alc M State Form 55551 Schedule Alc M S Download Fillable Pdf Or Fill Online Indiana Brewer Distiller Rectifier Vintner Excise Tax Schedule Indiana Templateroller

Alcohol Tax Increase Unlikely In 2018 Session Indiana Public Radio

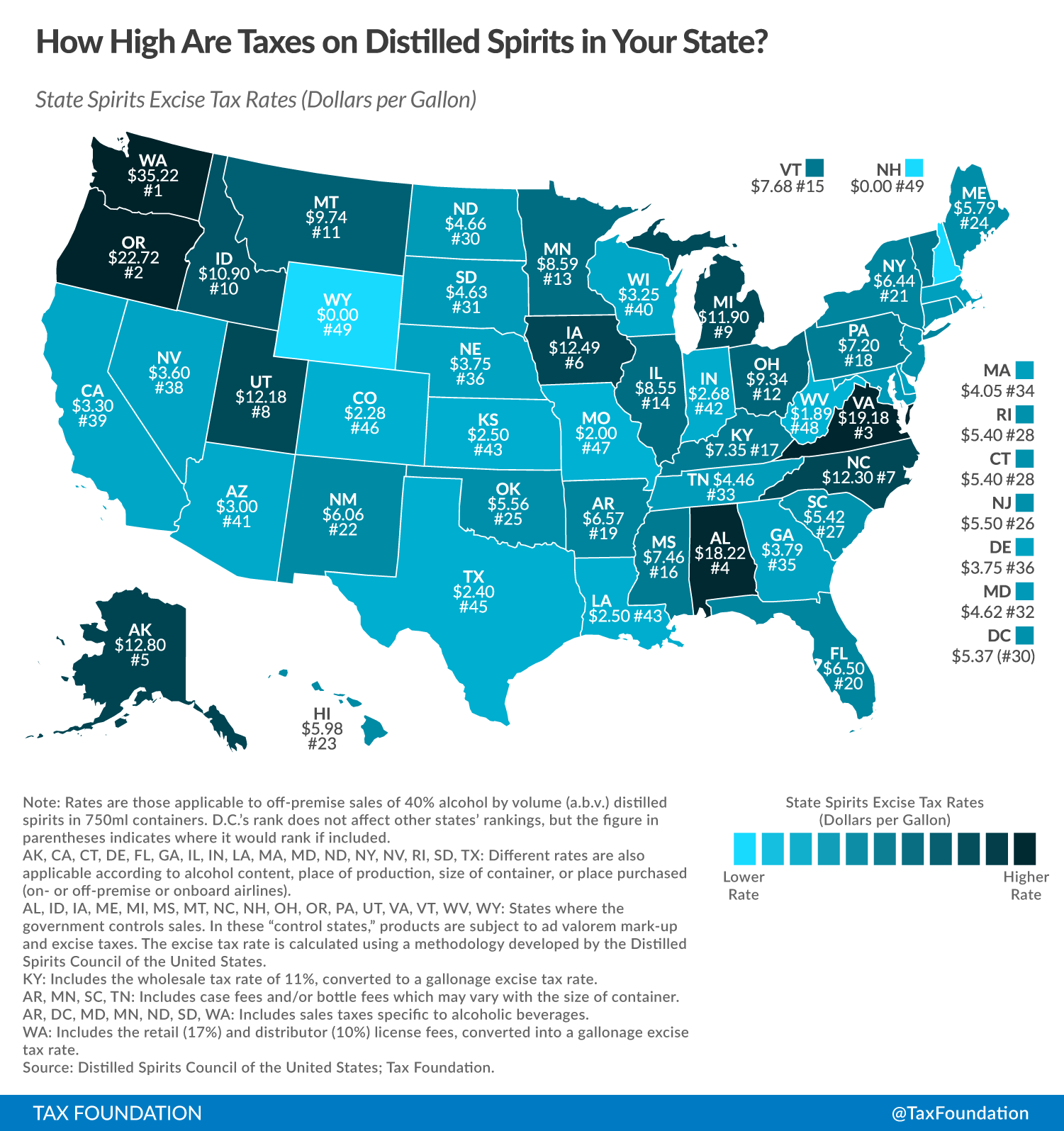

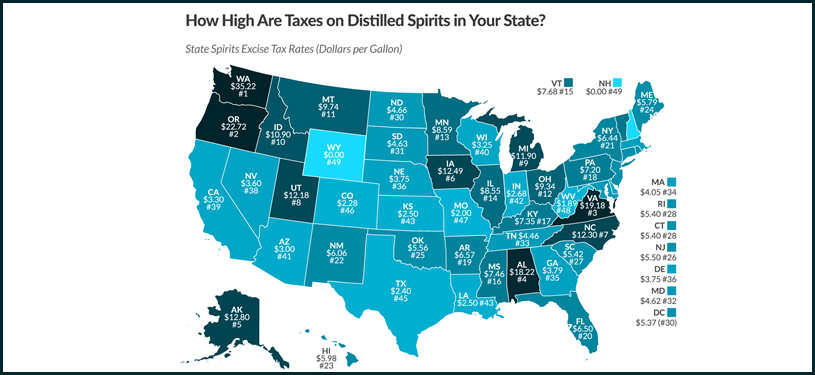

Part 2 How High Are Distilled Spirits Excise Taxes In Your State Infographic Distillery Trail

State Alcohol Excise Tax Rates Tax Policy Center

Indiana Alcoholic Beverage Laws And Rules Annotated Lexisnexis Store

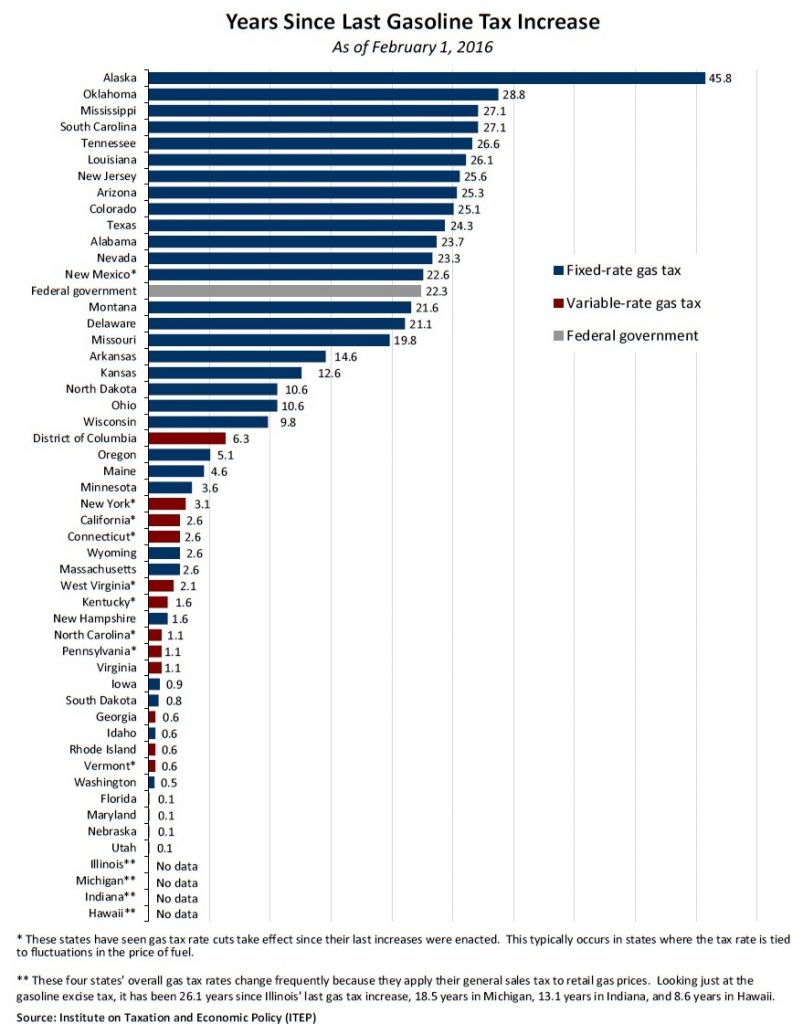

How Long Has It Been Since Your State Raised Its Gas Tax Itep

Form Alc M State Form 55551 Schedule Alc M S Download Fillable Pdf Or Fill Online Indiana Brewer Distiller Rectifier Vintner Excise Tax Schedule Indiana Templateroller

Indiana Alcohol Taxes Liquor Wine And Beer Taxes For 2022

Part 2 How High Are Distilled Spirits Excise Taxes In Your State Infographic Distillery Trail

Indiana Liquor Control Information Alcoholic Beverage Commission Laws

What States Have The Highest Alcohol Excise Taxes Alcohol Taxes Explained Diy Distilling

Indiana Alcohol Taxes Liquor Wine And Beer Taxes For 2022

State Form 55548 Alc M Download Fillable Pdf Or Fill Online Indiana Brewer Distiller Rectifier Vintner Excise Tax Return Indiana Templateroller

Liqour Taxes How High Are Distilled Spirits Taxes In Your State